Wylie car title loans are popular for quick funding but carry risks. High interest rates, repossession threats, and financial strain are concerns. Borrowers must research terms, avoid predatory practices, prioritize financial well-being, and borrow responsibly to mitigate risks associated with these loans.

“Wylie Car Title Loans: Unveiling Potential Pitfalls and Safeguards

In today’s financial landscape, understanding alternative lending options is crucial. This article delves into the intricacies of Wylie car title loans, highlighting both their basics and inherent risks. We explore common pitfalls that borrowers often face when securing these loans. Furthermore, we provide essential tips to protect yourself, empowering wise borrowing decisions in the competitive world of Wylie car title loans.”

- Understanding Wylie Car Title Loans: Basics and Risks

- Common Pitfalls to Avoid in Securing a Loan

- Protecting Yourself: Tips for Wise Borrowing Decisions

Understanding Wylie Car Title Loans: Basics and Risks

Wylie car title loans have gained popularity as a quick way to secure short-term funding by using your vehicle’s title as collateral. While this type of loan can provide access to cash for those in urgent need, it’s essential to understand the basics and risks involved. These loans are typically offered with a shorter repayment period, ranging from 30 days to a year, and often come with higher-than-average interest rates compared to traditional personal loans.

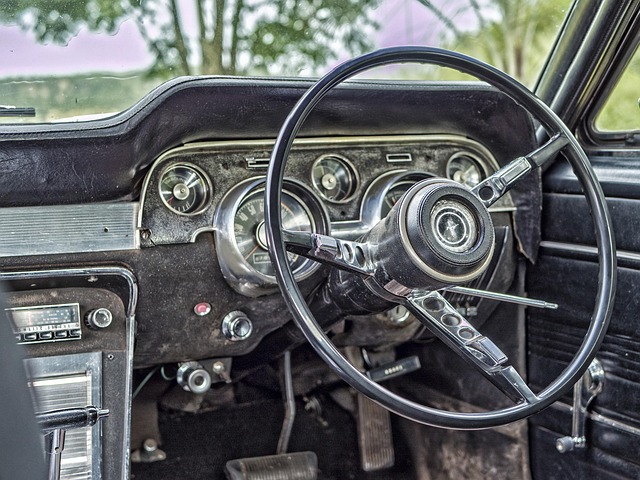

When considering a Wylie car title loan, borrowers should be aware of potential pitfalls. The primary risk lies in the possibility of defaulting on the loan, which could result in repossession of your vehicle. Additionally, loan extensions might lead to longer periods of financial strain and higher overall costs due to extended interest charges. Despite the flexibility of some lenders offering flexible payments, it’s crucial to evaluate your repayment capacity before pledging your vehicle’s title as collateral to avoid a cycle of debt. Loan eligibility criteria vary among lenders, so borrowers should thoroughly research and compare terms to make an informed decision.

Common Pitfalls to Avoid in Securing a Loan

When exploring Wylie car title loans, borrowers should be aware of several common pitfalls designed to trap them into less-than-favorable agreements. One major area to avoid is signing for a loan with exceptionally high-interest rates and hidden fees. Lenders that push for immediate approval without thorough explanation of the terms can lead to borrowers paying significantly more than intended over the life of the loan.

Additionally, be cautious about lenders who make it difficult or charge extra fees for the title transfer process. This is a crucial step in securing your vehicle valuation, and any attempts to complicate this can result in higher costs. It’s important to remember that while Wylie car title loans can provide much-needed financial assistance, borrowers should always prioritize transparency, reasonable terms, and fair interest rates to protect their interests.

Protecting Yourself: Tips for Wise Borrowing Decisions

When considering a Wylie car title loan, it’s paramount to prioritize your financial well-being and make informed decisions. These loans can be a helpful tool for accessing immediate financial assistance, but they come with risks if not managed wisely. One crucial tip is to ensure transparency from lenders; clear terms and conditions, interest rates, and repayment schedules are non-negotiable. Avoid lenders who employ aggressive sales tactics or offer unrealistic promises of same-day funding for Wylie car title loans.

Moreover, never borrow more than what you can comfortably repay. The vehicle’s value determines the loan amount, but remember, you’re putting up your car as collateral. If you struggle with bad credit, explore alternative options like building your credit score or seeking financial assistance from non-profit organizations before turning to a car title loan. Remember, making wise borrowing decisions today can save you from financial strain in the future.

When considering Wylie car title loans, being informed is key to avoiding common pitfalls. By understanding the basics and risks involved, and implementing wise borrowing decisions, you can navigate this type of loan with confidence. Remember, transparency and responsible lending practices are essential to a positive experience with Wylie car title loans.